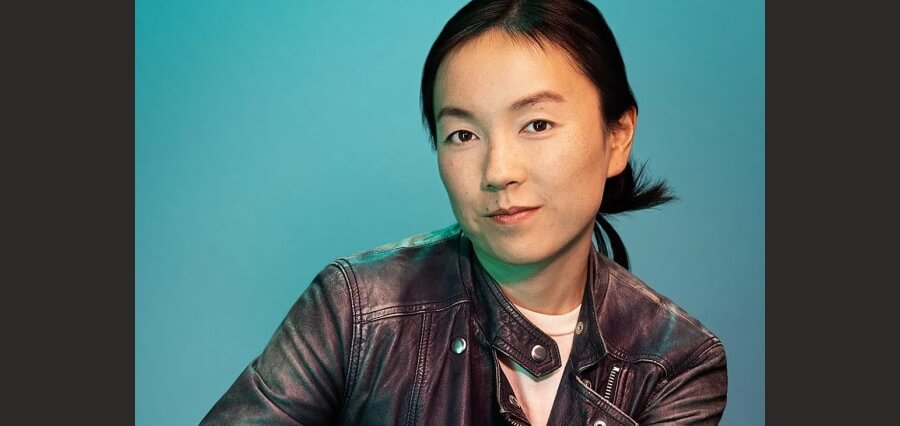

Yin Wu, with her fourth startup Pulley, is seizing the opportunity in the niche market for cap table management software, which is currently dominated by scandal-plagued Carta.

On Sunday, January 7, Yin Wu found her inbox flooded with inquiries from potential customers interested in her company’s product, which aids startups in tracking the ownership of their shares, commonly known as cap tables. Initially puzzled by the sudden surge in interest, Wu, aged 35, couldn’t comprehend why individuals would be discussing cap tables on a typical Sunday evening.

However, the reason behind the increased attention soon became evident. A LinkedIn post by Karri Saarinen, CEO of software project management startup Linear, had criticized Carta, the predominant player in capital table management, for trading Linear’s shares on its secondary marketplace without Saarinen’s authorization. A public spat between Saarinen and Carta CEO Henry Ward ensued on X (formerly Twitter) over the weekend, as the controversy reverberated across Silicon Valley. Ward attributed the issue to a rogue employee, while Saarinen claimed that other founders had faced similar problems.

Ultimately, on Monday, Ward published a public apology on Medium and announced Carta’s decision to close its secondary private shares trading operation to regain trust. However, by that time, many of Carta’s 40,000 customers had already begun exploring alternative solutions.

Meet Pulley, a San Francisco-based company emerging as a prominent competitor to Carta and earning a spot on this year’s Fintech 50 list. CEO Wu wasted no time diving into the competition, pledging on X that if founders made the switch to Pulley by the end of January, the company would discount its fees to offset the costs of their existing cap table contracts. This proactive move spurred an eightfold increase in demo requests compared to the previous month, attracting around 400 new customers. As a result, Pulley’s client base surged to 4,600, more than doubling from the 2,200 it had at the start of 2023.

For serial entrepreneur Wu, this was a fortuitous and well-timed opportunity. Unfazed by entering the cap table market seven years after Carta established itself as the leader, she believes that being first isn’t the only path to success in the long run.

Drawing a parallel to Stripe’s rise in the payment processing industry, Wu highlights that success often hinges on providing a superior user experience rather than being the pioneer. Despite existing players like Braintree, Amazon Pay, and PayPal, customers weren’t necessarily thrilled with their experiences. Wu’s bet is that Pulley can offer something better.

Currently, Pulley operates under the looming presence of Carta, boasting 40,000 customers and a valuation of $7.4 billion as of its last fundraising round in August 2021. While Carta declined to comment to Forbes, an analysis by market research firm CB Insights revealed that 89% of surveyed Carta customers expressed intentions to renew their plans.

Despite this, Pulley has secured $50 million in funding from prominent backers such as Stripe, Founders Fund, and angel investors like Elad Gil, Jack Altman, and Avichal Garg, who happens to be Wu’s husband. In its Series B round in October 2022, Pulley achieved a valuation of $250 million.

Wu asserts that Pulley’s technology for fundraising modeling surpasses that of its competitors. This technology aids founders in understanding the precise extent of their stake dilution due to complex early-stage funding structures. Additionally, Pulley offers tools such as the offer letter tool, which efficiently tracks equity grants to new hires on the cap table and streamlines the process of board approval and distribution of option grants.

Read More: https://womenworldmagazine.com/

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/en/register?ref=JHQQKNKN

Recently, I needed Zithromax urgently and stumbled upon a great source. It allows you to get treatment fast securely. For treating a bacterial infection, this is the best place. Fast shipping guaranteed. Link: http://antibioticsexpress.com/#. Hope you feel better.

Just now, I wanted to buy antibiotics fast and came across a reliable pharmacy. It allows you to get treatment fast safely. For treating a bacterial infection, this is the best place. Express delivery guaranteed. More info: online antibiotics pharmacy. Good luck.

Hey there! I discovered a useful online drugstore if you need prescriptions fast. The site provides huge discounts on Rx drugs. If you want to save, take a look: express pharmacy. Cheers.

Hi! Just wanted to share a great pharmacy online if you need generics at a discount. Pharmiexpress provides the best prices on all meds. For fast service, visit here: pharmacy online. Cheers.

Canlı casino oynamak isteyenler için rehber niteliğinde bir site: mobil ödeme bahis Hangi site güvenilir diye düşünmeyin. Onaylı bahis siteleri listesi ile sorunsuz oynayın. Detaylar linkte.

Bu sene popüler olan casino siteleri hangileri? Cevabı web sitemizde mevcuttur. Deneme bonusu veren siteleri ve güncel giriş linklerini paylaşıyoruz. İncelemek için https://cassiteleri.us.org/# casino siteleri 2026 kazanmaya başlayın.

Pin Up Casino Azərbaycanda ən populyar kazino saytıdır. Burada minlərlə oyun və canlı dilerlər var. Pulu kartınıza tez köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Giriş linki ətraflı məlumat tövsiyə edirəm.

2026 yД±lД±nda popГјler olan casino siteleri hangileri? DetaylД± liste platformumuzda mevcuttur. Deneme bonusu veren siteleri ve gГјncel giriЕџ linklerini paylaЕџД±yoruz. Hemen tД±klayД±n п»їcanlД± casino siteleri kazanmaya baЕџlayД±n.

Pin Up Casino ölkəmizdə ən populyar platformadır. Saytda çoxlu slotlar və canlı dilerlər var. Pulu kartınıza tez köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Giriş linki Pin Up Azerbaijan tövsiyə edirəm.

Canlı casino oynamak isteyenler için rehber niteliğinde bir site: casino siteleri Nerede oynanır diye düşünmeyin. Editörlerimizin seçtiği bahis siteleri listesi ile sorunsuz oynayın. Detaylar linkte.

Info slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini gampang menang dan resmi. Promo menarik menanti anda. Akses link: klik disini raih kemanangan.

Bonaslot adalah bandar judi slot online terpercaya di Indonesia. Ribuan member sudah mendapatkan Jackpot sensasional disini. Proses depo WD super cepat hanya hitungan menit. Situs resmi п»їBonaslot slot gas sekarang bosku.

Bu sene popüler olan casino siteleri hangileri? Cevabı platformumuzda mevcuttur. Bedava bahis veren siteleri ve güncel giriş linklerini paylaşıyoruz. İncelemek için https://cassiteleri.us.org/# bonus veren siteler kazanmaya başlayın.

п»їSalam Gacor, lagi nyari situs slot yang gacor? Rekomendasi kami adalah Bonaslot. RTP Live tertinggi hari ini dan terbukti membayar. Deposit bisa pakai OVO tanpa potongan. Daftar sekarang: п»їBonaslot login semoga maxwin.

Canlı casino oynamak isteyenler için rehber niteliğinde bir site: casino siteleri 2026 Nerede oynanır diye düşünmeyin. Editörlerimizin seçtiği casino siteleri listesi ile rahatça oynayın. Tüm liste linkte.

Bonaslot adalah agen judi slot online nomor 1 di Indonesia. Banyak member sudah mendapatkan Maxwin sensasional disini. Transaksi super cepat kilat. Link alternatif п»їlogin sekarang jangan sampai ketinggalan.

Salamlar, siz dÉ™ etibarlı kazino axtarırsınızsa, mütlÉ™q Pin Up saytını yoxlayasınız. Æn yaxşı slotlar vÉ™ sürÉ™tli ödÉ™niÅŸlÉ™r burada mövcuddur. Ä°ndi qoÅŸulun vÉ™ bonus qazanın. Daxil olmaq üçün link: https://pinupaz.jp.net/# rÉ™smi sayt uÄŸurlar hÉ™r kÉ™sÉ™!

Salam Gacor, cari situs slot yang mudah menang? Coba main di Bonaslot. RTP Live tertinggi hari ini dan pasti bayar. Deposit bisa pakai Pulsa tanpa potongan. Daftar sekarang: Bonaslot login salam jackpot.

2026 yılında popüler olan casino siteleri hangileri? Detaylı liste web sitemizde mevcuttur. Deneme bonusu veren siteleri ve güncel giriş linklerini paylaşıyoruz. Hemen tıklayın cassiteleri.us.org fırsatı kaçırmayın.

Salam dostlar, siz də keyfiyyətli kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Yüksək əmsallar və rahat pul çıxarışı burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Daxil olmaq üçün link: https://pinupaz.jp.net/# Pin Up rəsmi sayt uğurlar hər kəsə!

Pin-Up AZ Azərbaycanda ən populyar kazino saytıdır. Burada çoxlu slotlar və canlı dilerlər var. Qazancı kartınıza anında köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Rəsmi sayt Pin Up Azerbaijan tövsiyə edirəm.

Pin Up Casino Azərbaycanda ən populyar kazino saytıdır. Saytda çoxlu slotlar və canlı dilerlər var. Qazancı kartınıza tez köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Rəsmi sayt Pin Up Azerbaijan tövsiyə edirəm.

Bu sene en çok kazandıran casino siteleri hangileri? Cevabı platformumuzda mevcuttur. Deneme bonusu veren siteleri ve yeni adres linklerini paylaşıyoruz. Hemen tıklayın güvenilir casino siteleri fırsatı kaçırmayın.

Info slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini anti rungkad dan aman. Bonus new member menanti anda. Akses link: https://bonaslotind.us.com/# situs slot resmi raih kemanangan.

Hər vaxtınız xeyir, siz də etibarlı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Yüksək əmsallar və sürətli ödənişlər burada mövcuddur. İndi qoşulun və bonus qazanın. Daxil olmaq üçün link: Pin Up yüklə uğurlar hər kəsə!

Info slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini anti rungkad dan resmi. Promo menarik menanti anda. Akses link: п»їhttps://bonaslotind.us.com/# Bonaslot daftar dan menangkan.

Situs Bonaslot adalah bandar judi slot online nomor 1 di Indonesia. Banyak member sudah merasakan Jackpot sensasional disini. Transaksi super cepat kilat. Situs resmi bonaslotind.us.com gas sekarang bosku.

Selamlar, sağlam casino siteleri bulmak istiyorsanız, hazırladığımız listeye mutlaka göz atın. Lisanslı firmaları ve bonusları sizin için listeledik. Dolandırılmamak için doğru adres: https://cassiteleri.us.org/# cassiteleri.us.org iyi kazançlar.

Bonaslot adalah agen judi slot online nomor 1 di Indonesia. Ribuan member sudah merasakan Jackpot sensasional disini. Transaksi super cepat kilat. Link alternatif slot gacor hari ini gas sekarang bosku.

Bocoran slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini anti rungkad dan resmi. Promo menarik menanti anda. Kunjungi: п»їhttps://bonaslotind.us.com/# daftar situs judi slot raih kemanangan.

Yeni Pin Up giriş ünvanını axtarırsınızsa, doğru yerdesiniz. Bloklanmayan link vasitəsilə hesabınıza girin və oynamağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: Pin Up kazino uğurlar.

Selam, ödeme yapan casino siteleri bulmak istiyorsanız, bu siteye kesinlikle göz atın. En iyi firmaları ve fırsatları sizin için listeledik. Dolandırılmamak için doğru adres: https://cassiteleri.us.org/# canlı casino siteleri iyi kazançlar.

2026 yılında en çok kazandıran casino siteleri hangileri? Detaylı liste web sitemizde mevcuttur. Deneme bonusu veren siteleri ve yeni adres linklerini paylaşıyoruz. İncelemek için listeyi gör fırsatı kaçırmayın.

Merhaba arkadaşlar, ödeme yapan casino siteleri bulmak istiyorsanız, bu siteye mutlaka göz atın. En iyi firmaları ve bonusları sizin için listeledik. Dolandırılmamak için doğru adres: cassiteleri.us.org bol şanslar.

Bonaslot adalah bandar judi slot online nomor 1 di Indonesia. Banyak member sudah mendapatkan Jackpot sensasional disini. Transaksi super cepat hanya hitungan menit. Situs resmi п»їhttps://bonaslotind.us.com/# Bonaslot login jangan sampai ketinggalan.

Merhaba arkadaşlar, ödeme yapan casino siteleri bulmak istiyorsanız, hazırladığımız listeye mutlaka göz atın. Lisanslı firmaları ve fırsatları sizin için listeledik. Dolandırılmamak için doğru adres: siteyi incele iyi kazançlar.

Info slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan aman. Bonus new member menanti anda. Akses link: https://bonaslotind.us.com/# Bonaslot slot raih kemanangan.

2026 yılında popüler olan casino siteleri hangileri? Cevabı platformumuzda mevcuttur. Bedava bahis veren siteleri ve güncel giriş linklerini paylaşıyoruz. Hemen tıklayın siteyi incele fırsatı kaçırmayın.

Situs Bonaslot adalah bandar judi slot online terpercaya di Indonesia. Banyak member sudah mendapatkan Jackpot sensasional disini. Proses depo WD super cepat hanya hitungan menit. Situs resmi login sekarang gas sekarang bosku.

Salam dostlar, siz də yaxşı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Canlı oyunlar və sürətli ödənişlər burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Daxil olmaq üçün link: bura daxil olun uğurlar hər kəsə!

Aktual Pin Up giriş ünvanını axtarırsınızsa, bura baxa bilərsiniz. Bloklanmayan link vasitəsilə hesabınıza girin və qazanmağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: https://pinupaz.jp.net/# sayta keçid qazancınız bol olsun.

Aktual Pin Up giriş ünvanını axtaranlar, bura baxa bilərsiniz. Bloklanmayan link vasitəsilə qeydiyyat olun və qazanmağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: Pin-Up Casino qazancınız bol olsun.

Yeni Pin Up giriş ünvanını axtaranlar, doğru yerdesiniz. Bloklanmayan link vasitəsilə hesabınıza girin və qazanmağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: https://pinupaz.jp.net/# Pin Up yüklə uğurlar.

Bonaslot adalah bandar judi slot online terpercaya di Indonesia. Ribuan member sudah mendapatkan Jackpot sensasional disini. Proses depo WD super cepat hanya hitungan menit. Situs resmi п»їslot gacor hari ini jangan sampai ketinggalan.

Canlı casino oynamak isteyenler için rehber niteliğinde bir site: canlı casino siteleri Nerede oynanır diye düşünmeyin. Onaylı bahis siteleri listesi ile sorunsuz oynayın. Detaylar linkte.

Pin-Up AZ ölkəmizdə ən populyar platformadır. Burada minlərlə oyun və Aviator var. Qazancı kartınıza tez köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Giriş linki https://pinupaz.jp.net/# Pin Up baxın.

Online slot oynamak isteyenler için rehber niteliğinde bir site: cassiteleri.us.org Hangi site güvenilir diye düşünmeyin. Editörlerimizin seçtiği bahis siteleri listesi ile rahatça oynayın. Tüm liste linkte.

Info slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini gampang menang dan aman. Promo menarik menanti anda. Akses link: п»їslot gacor hari ini dan menangkan.

Bocoran slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan aman. Promo menarik menanti anda. Akses link: login sekarang dan menangkan.

Pin Up Casino Azərbaycanda ən populyar platformadır. Burada minlərlə oyun və canlı dilerlər var. Qazancı kartınıza tez köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Giriş linki https://pinupaz.jp.net/# pinupaz.jp.net yoxlayın.

Aktual Pin Up giriş ünvanını axtarırsınızsa, doğru yerdesiniz. İşlək link vasitəsilə hesabınıza girin və oynamağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: Pin Up kazino qazancınız bol olsun.

Bu sene en Г§ok kazandД±ran casino siteleri hangileri? CevabД± platformumuzda mevcuttur. Deneme bonusu veren siteleri ve gГјncel giriЕџ linklerini paylaЕџД±yoruz. Hemen tД±klayД±n п»їhttps://cassiteleri.us.org/# gГјvenilir casino siteleri kazanmaya baЕџlayД±n.

Situs Bonaslot adalah bandar judi slot online nomor 1 di Indonesia. Ribuan member sudah merasakan Maxwin sensasional disini. Transaksi super cepat kilat. Link alternatif п»їhttps://bonaslotind.us.com/# Bonaslot daftar gas sekarang bosku.

Bu sene popüler olan casino siteleri hangileri? Detaylı liste web sitemizde mevcuttur. Bedava bahis veren siteleri ve güncel giriş linklerini paylaşıyoruz. İncelemek için https://cassiteleri.us.org/# casino siteleri 2026 kazanmaya başlayın.

Info slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini anti rungkad dan resmi. Bonus new member menanti anda. Akses link: п»їBonaslot slot dan menangkan.

Aktual Pin Up giriş ünvanını axtarırsınızsa, bura baxa bilərsiniz. İşlək link vasitəsilə hesabınıza girin və oynamağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: Pin Up kazino uğurlar.

Bocoran slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini gampang menang dan aman. Bonus new member menanti anda. Akses link: situs slot resmi dan menangkan.

Bocoran slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan aman. Promo menarik menanti anda. Kunjungi: п»їBonaslot login dan menangkan.

Situs Bonaslot adalah agen judi slot online nomor 1 di Indonesia. Banyak member sudah mendapatkan Jackpot sensasional disini. Transaksi super cepat kilat. Situs resmi Bonaslot slot jangan sampai ketinggalan.

Canlı casino oynamak isteyenler için kılavuz niteliğinde bir site: bonus veren siteler Nerede oynanır diye düşünmeyin. Editörlerimizin seçtiği bahis siteleri listesi ile sorunsuz oynayın. Detaylar linkte.

To be honest, Lately stumbled upon the best website to save on Rx. If you need medicines from India at factory prices, IndiaPharm is the best place. You get wholesale rates guaranteed. Visit here: read more. Hope it helps.

Hey everyone, I recently discovered a reliable website where you can buy pills securely. If you are looking for no prescription drugs, OnlinePharm is very good. They ship globally plus it is very affordable. See for yourself: https://onlinepharm.jp.net/#. Best of luck.

Greetings, I just found a reliable website for purchasing medications cheaply. If you need no prescription drugs, this site is the best choice. Great prices and no script needed. Check it out: safe online drugstore. Best regards.

Greetings, Just now came across a great resource to buy medication. For those seeking and need affordable prescriptions, Pharm Mex is highly recommended. They ship to USA plus very reliable. Check it out: safe mexican pharmacy. Cheers.

Hello, I just found a great source for meds to order generics cheaply. If you need safe pharmacy delivery, this store is highly recommended. Secure shipping plus huge selection. Check it out: onlinepharm.jp.net. Stay safe.

To be honest, Lately ran into an awesome Mexican pharmacy to buy medication. If you want to save money and need generic drugs, this store is the best option. No prescription needed and very reliable. Visit here: https://pharm.mex.com/#. Best of luck.

Hey there, Lately came across a trusted resource to buy medication. If you are tired of high prices and want meds from Mexico, this store is the best option. Fast shipping plus secure. Visit here: https://pharm.mex.com/#. Good luck!

Greetings, I recently discovered a reliable website to order medications online. For those who need cheap meds, OnlinePharm is worth a look. They ship globally plus huge selection. Visit here: https://onlinepharm.jp.net/#. Hope this was useful.

Hi, I wanted to share a great website where you can buy pills hassle-free. For those who need no prescription drugs, this site is the best choice. Fast delivery and no script needed. See for yourself: online pharmacy usa. Thanks!

Hi all, Lately came across an amazing source from India for affordable pills. If you want to buy ED meds without prescription, IndiaPharm is very reliable. It has wholesale rates guaranteed. Check it out: check availability. Cheers.

Hi, I wanted to share a useful international pharmacy to order medications cheaply. If you need antibiotics, OnlinePharm is very good. They ship globally and huge selection. Check it out: click here. Kind regards.

Hey guys, I recently discovered a great source from India for affordable pills. For those looking for medicines from India cheaply, this site is the best place. It has wholesale rates guaranteed. Take a look: https://indiapharm.in.net/#. Cheers.

To be honest, I recently stumbled upon a great Indian pharmacy to save on Rx. If you need ED meds cheaply, this site is worth checking. They offer wholesale rates worldwide. Check it out: https://indiapharm.in.net/#. Good luck.

Hey everyone, To be honest, I found a useful source for meds to order medications online. If you are looking for no prescription drugs, this store is very good. They ship globally plus huge selection. See for yourself: buy meds online. Hope this was useful.

Hey guys, Just now stumbled upon the best source from India to save on Rx. If you need medicines from India safely, this store is highly recommended. You get fast shipping guaranteed. Visit here: https://indiapharm.in.net/#. Cheers.

Hey there, I wanted to share an excellent source for meds where you can buy pills online. For those who need safe pharmacy delivery, this store is highly recommended. Great prices and it is very affordable. Check it out: OnlinePharm. Sincerely.

Hi guys, Lately came across a reliable website to save on Rx. For those seeking and want generic drugs, this site is highly recommended. They ship to USA plus secure. Take a look: read more. Peace.

Hey everyone, To be honest, I found a useful international pharmacy where you can buy pills cheaply. If you need safe pharmacy delivery, this store is very good. They ship globally and no script needed. Visit here: online pharmacy no prescription. Thank you.

To be honest, Just now found an awesome website for affordable pills. If you want to save money and want generic drugs, Pharm Mex is highly recommended. They ship to USA and very reliable. Take a look: buy meds from mexico. Appreciate it.

Greetings, I recently stumbled upon a great Indian pharmacy to buy generics. If you need generic pills at factory prices, this site is worth checking. It has fast shipping to USA. More info here: click here. Hope it helps.

Hey there, To be honest, I found a reliable online drugstore for purchasing generics hassle-free. If you need safe pharmacy delivery, this site is very good. They ship globally plus no script needed. See for yourself: online pharmacy usa. Good luck with everything.

Hello, I recently found an amazing online drugstore to save on Rx. If you need ED meds at factory prices, this site is very reliable. They offer lowest prices guaranteed. Check it out: https://indiapharm.in.net/#. Cheers.

Hey there, I just found an excellent source for meds where you can buy prescription drugs online. If you are looking for cheap meds, this store is the best choice. Great prices and it is very affordable. Check it out: international pharmacy online. Warmly.

Hello, I recently discovered a great online drugstore to buy generics. If you want to buy cheap antibiotics safely, this site is worth checking. You get secure delivery guaranteed. Take a look: safe indian pharmacy. Good luck.

Hello, Just now came across an amazing website to save on Rx. If you want to buy cheap antibiotics without prescription, this store is the best place. You get secure delivery to USA. Check it out: https://indiapharm.in.net/#. Best regards.

Hey there, To be honest, I found a great source for meds to order medications securely. If you need antibiotics, this site is the best choice. Great prices plus it is very affordable. Visit here: https://onlinepharm.jp.net/#. All the best.

Greetings, I recently found the best Indian pharmacy to buy generics. If you need ED meds safely, this site is very reliable. You get lowest prices worldwide. Take a look: India Pharm Store. Cheers.

Hey everyone, To be honest, I found a great international pharmacy where you can buy prescription drugs hassle-free. If you are looking for antibiotics, this site is very good. Secure shipping and no script needed. Link here: safe online drugstore. Best regards.

Greetings, Lately found a useful website for cheap meds. For those looking for ED meds at factory prices, IndiaPharm is worth checking. It has fast shipping worldwide. Visit here: indian pharmacy online. Best regards.

Hey everyone, I just found an excellent source for meds to order generics online. If you are looking for no prescription drugs, OnlinePharm is the best choice. They ship globally and huge selection. Link here: https://onlinepharm.jp.net/#. Stay healthy.

Greetings, Just now discovered the best website for cheap meds. If you need cheap antibiotics without prescription, this site is very reliable. You get wholesale rates to USA. Visit here: indian pharmacy online. Cheers.

Hi, I just found a great source for meds for purchasing medications hassle-free. If you are looking for safe pharmacy delivery, this site is worth a look. They ship globally and no script needed. Link here: online pharmacy no prescription. Best regards.

Hello, I recently found a great Indian pharmacy to save on Rx. If you want to buy generic pills cheaply, this store is worth checking. It has secure delivery to USA. Check it out: India Pharm Store. Cheers.

Greetings, I recently discovered a great website for purchasing medications online. For those who need cheap meds, OnlinePharm is very good. They ship globally and no script needed. Visit here: this site. Get well soon.

Hi, To be honest, I found a useful international pharmacy where you can buy prescription drugs cheaply. If you need cheap meds, OnlinePharm is worth a look. Fast delivery and it is very affordable. Check it out: click here. Be well.

To be honest, Just now came across an awesome Mexican pharmacy for affordable pills. For those seeking and want affordable prescriptions, this site is the best option. Great prices plus it is safe. Visit here: safe mexican pharmacy. Sincerely.

Hey there, I just found an excellent international pharmacy where you can buy pills cheaply. If you need no prescription drugs, this store is highly recommended. They ship globally plus it is very affordable. Link here: https://onlinepharm.jp.net/#. Thanks!

Hello everyone, Lately found a trusted website for affordable pills. For those seeking and need meds from Mexico, Pharm Mex is highly recommended. Fast shipping plus secure. Take a look: safe mexican pharmacy. Best of luck.

Greetings, Just now discovered a great website for affordable pills. If you are tired of high prices and need affordable prescriptions, this site is a game changer. Fast shipping plus it is safe. Take a look: cheap antibiotics mexico. Thanks!

Hey everyone, To be honest, I found a reliable source for meds where you can buy medications cheaply. For those who need cheap meds, this store is very good. Great prices and it is very affordable. Link here: https://onlinepharm.jp.net/#. Have a good one.

Greetings, I recently discovered an excellent international pharmacy where you can buy pills hassle-free. If you are looking for no prescription drugs, OnlinePharm is highly recommended. Secure shipping and no script needed. Check it out: Online Pharm Store. I hope you find what you need.

Hi guys, I just ran into a trusted resource for cheap meds. If you are tired of high prices and need generic drugs, Pharm Mex is the best option. They ship to USA and it is safe. Take a look: https://pharm.mex.com/#. Thx.

Hey guys, Lately found a great online drugstore for cheap meds. For those looking for medicines from India safely, IndiaPharm is worth checking. They offer secure delivery worldwide. Take a look: https://indiapharm.in.net/#. Good luck.

Hello, Just now found a useful website for cheap meds. For those looking for generic pills at factory prices, IndiaPharm is very reliable. It has fast shipping guaranteed. Take a look: India Pharm Store. Cheers.

To be honest, Just now discovered a useful website to save on Rx. If you want to buy medicines from India safely, this site is worth checking. It has wholesale rates to USA. Visit here: https://indiapharm.in.net/#. Best regards.

Hey there, Lately found an awesome Mexican pharmacy to buy medication. If you are tired of high prices and want generic drugs, this store is the best option. They ship to USA and it is safe. Visit here: https://pharm.mex.com/#. Be well.

Hi guys, Just now came across a reliable online source to buy medication. If you are tired of high prices and need cheap antibiotics, this site is highly recommended. They ship to USA and very reliable. Visit here: Pharm Mex. Best wishes.

Hello, I recently found a great website to buy generics. If you need generic pills at factory prices, this store is highly recommended. You get wholesale rates worldwide. Visit here: India Pharm Store. Good luck.

Hello everyone, I recently found a reliable online source for cheap meds. For those seeking and want generic drugs, Pharm Mex is the best option. No prescription needed plus secure. Take a look: this site. All the best.

Hi all, I just stumbled upon an amazing website to buy generics. For those looking for ED meds cheaply, IndiaPharm is the best place. You get wholesale rates guaranteed. More info here: visit website. Hope it helps.

Greetings, I just discovered a great website to buy medication. If you want to save money and need affordable prescriptions, Pharm Mex is the best option. They ship to USA and secure. Visit here: https://pharm.mex.com/#. Have a great week.

To be honest, I recently discovered a great website for cheap meds. If you want to buy cheap antibiotics cheaply, this store is very reliable. It has wholesale rates guaranteed. Check it out: https://indiapharm.in.net/#. Good luck.

Hi guys, I just found a trusted website for cheap meds. If you want to save money and need affordable prescriptions, Pharm Mex is the best option. They ship to USA and it is safe. Link is here: https://pharm.mex.com/#. Many thanks.

Hi guys, I just found a great website for cheap meds. If you want to save money and need affordable prescriptions, this site is highly recommended. No prescription needed plus it is safe. Link is here: https://pharm.mex.com/#. Take care.

Hello, Lately came across an amazing website to buy generics. For those looking for medicines from India cheaply, IndiaPharm is highly recommended. You get lowest prices worldwide. More info here: safe indian pharmacy. Good luck.

Herkese merhaba, bu site oyuncuları adına kısa bir bilgilendirme yapmak istiyorum. Bildiğiniz gibi platform giriş linkini tekrar değiştirdi. Giriş hatası yaşıyorsanız endişe etmeyin. Son Vay Casino giriş linki şu an aşağıdadır: https://vaycasino.us.com/# Paylaştığım bağlantı ile doğrudan siteye girebilirsiniz. Güvenilir casino deneyimi sürdürmek için Vaycasino tercih edebilirsiniz. Tüm forum üyelerine bol şans dilerim.

Herkese merhaba, Casibom sitesi oyuncular? ad?na onemli bir paylas?m paylas?yorum. Bildiginiz gibi site adresini erisim k?s?tlamas? nedeniyle yine degistirdi. Erisim sorunu yas?yorsan?z cozum burada. Son siteye erisim baglant?s? su an paylas?yorum Casibom Kay?t Paylast?g?m baglant? ile vpn kullanmadan siteye erisebilirsiniz. Ayr?ca yeni uyelere sunulan yat?r?m bonusu f?rsatlar?n? da kac?rmay?n. Lisansl? slot keyfi surdurmek icin Casibom dogru adres. Tum forum uyelerine bol sans dilerim.

Arkadaslar, Grandpashabet Casino son linki ac?kland?. Giremeyenler su linkten devam edebilir Buraya T?kla

Grandpasha giriş adresi lazımsa işte burada. Sorunsuz erişim için tıkla Grandpashabet Kayıt Deneme bonusu burada.

Grandpashabet guncel adresi laz?msa iste burada. Sorunsuz erisim icin https://grandpashabet.in.net/# Yuksek oranlar bu sitede.

Gençler, Grandpashabet Casino yeni adresi açıklandı. Giremeyenler buradan devam edebilir Hemen Oyna

Arkadaşlar selam, bu popüler site oyuncuları adına önemli bir bilgilendirme paylaşıyorum. Herkesin bildiği üzere Casibom adresini erişim kısıtlaması nedeniyle tekrar güncelledi. Erişim problemi yaşıyorsanız doğru yerdesiniz. Çalışan Casibom giriş adresi şu an paylaşıyorum Casibom Apk Bu link ile doğrudan hesabınıza girebilirsiniz. Ek olarak kayıt olanlara sunulan freespin fırsatlarını da inceleyin. Lisanslı slot deneyimi için Casibom tercih edebilirsiniz. Tüm forum üyelerine bol şans dilerim.

Grandpasha giris adresi ar?yorsan?z iste burada. Sorunsuz erisim icin https://grandpashabet.in.net/# Yuksek oranlar burada.

Matbet TV giris adresi ar?yorsan?z iste burada. Sorunsuz icin t?kla: Matbet Guvenilir mi Yuksek oranlar bu sitede. Gencler, Matbet yeni adresi ac?kland?.

Grandpashabet giriş linki arıyorsanız işte burada. Sorunsuz erişim için Grandpashabet Güvenilir mi Yüksek oranlar bu sitede.

Matbet TV giris linki ar?yorsan?z iste burada. Mac izlemek icin t?kla: Matbet Guvenilir mi Canl? maclar bu sitede. Arkadaslar, Matbet yeni adresi belli oldu.

Matbet güncel adresi lazımsa işte burada. Sorunsuz için tıkla: Siteye Git Canlı maçlar bu sitede. Arkadaşlar, Matbet bahis yeni adresi açıklandı.

Grandpasha guncel linki laz?msa dogru yerdesiniz. Sorunsuz erisim icin t?kla https://grandpashabet.in.net/# Yuksek oranlar burada.

Herkese merhaba, bu site oyuncular? ad?na k?sa bir bilgilendirme paylas?yorum. Malum Vaycasino adresini yine degistirdi. Erisim hatas? varsa endise etmeyin. Cal?san siteye erisim adresi art?k asag?dad?r: https://vaycasino.us.com/# Paylast?g?m baglant? uzerinden vpn kullanmadan hesab?n?za erisebilirsiniz. Guvenilir casino deneyimi surdurmek icin Vay Casino tercih edebilirsiniz. Herkese bol sans temenni ederim.

Herkese merhaba, Casibom oyuncuları için önemli bir paylaşım paylaşıyorum. Herkesin bildiği üzere bahis platformu domain adresini erişim kısıtlaması nedeniyle tekrar taşıdı. Siteye ulaşım hatası çekenler için link aşağıda. Güncel Casibom giriş adresi şu an aşağıdadır Casibom Bonus Bu link ile doğrudan hesabınıza bağlanabilirsiniz. Ek olarak kayıt olanlara sunulan freespin kampanyalarını mutlaka kaçırmayın. Güvenilir bahis deneyimi için Casibom tercih edebilirsiniz. Herkese bol kazançlar dilerim.

Dostlar selam, Vay Casino oyuncular? ad?na k?sa bir duyuru yapmak istiyorum. Bildiginiz gibi platform adresini tekrar degistirdi. Erisim hatas? varsa endise etmeyin. Guncel Vaycasino giris adresi art?k asag?dad?r: Vay Casino Apk Paylast?g?m baglant? ile dogrudan siteye erisebilirsiniz. Lisansl? casino keyfi icin Vay Casino tercih edebilirsiniz. Herkese bol kazanclar dilerim.

Grandpasha giriş adresi lazımsa işte burada. Sorunsuz giriş yapmak için tıkla Grandpashabet Giriş Deneme bonusu bu sitede.

Matbet giris linki ar?yorsan?z iste burada. H?zl? icin t?kla: Matbet Indir Canl? maclar burada. Gencler, Matbet bahis yeni adresi belli oldu.

Arkadaşlar selam, Casibom kullanıcıları için kısa bir paylaşım paylaşıyorum. Herkesin bildiği üzere site adresini BTK engeli yüzünden yine güncelledi. Erişim hatası varsa link aşağıda. Yeni Casibom güncel giriş linki şu an burada https://casibom.mex.com/# Paylaştığım bağlantı ile vpn kullanmadan hesabınıza bağlanabilirsiniz. Ek olarak yeni üyelere sunulan yatırım bonusu kampanyalarını mutlaka kaçırmayın. Lisanslı casino deneyimi sürdürmek için Casibom doğru adres. Herkese bol kazançlar dilerim.

Herkese selam, bu site oyuncular? ad?na onemli bir duyuru paylas?yorum. Malum site adresini yine degistirdi. Erisim hatas? yas?yorsan?z panik yapmay?n. Son Vay Casino giris linki su an asag?dad?r: https://vaycasino.us.com/# Paylast?g?m baglant? ile vpn kullanmadan siteye girebilirsiniz. Guvenilir bahis keyfi surdurmek icin Vaycasino dogru adres. Tum forum uyelerine bol sans dilerim.

Matbet giriş linki arıyorsanız işte burada. Sorunsuz için: https://matbet.jp.net/# Canlı maçlar burada. Gençler, Matbet bahis son linki açıklandı.

Arkadaslar, Grandpashabet yeni adresi ac?kland?. Giremeyenler su linkten devam edebilir Buraya T?kla

Arkadaşlar, Grandpashabet Casino son linki belli oldu. Adresi bulamayanlar buradan giriş yapabilir Grandpashabet

Dostlar selam, bu site oyuncular? icin onemli bir bilgilendirme paylas?yorum. Malum Vaycasino giris linkini tekrar degistirdi. Giris sorunu varsa panik yapmay?n. Cal?san Vaycasino giris adresi art?k burada: https://vaycasino.us.com/# Bu link uzerinden direkt hesab?n?za girebilirsiniz. Lisansl? bahis deneyimi surdurmek icin Vay Casino dogru adres. Herkese bol sans temenni ederim.

Matbet giris linki ar?yorsan?z iste burada. H?zl? icin: Giris Yap Yuksek oranlar bu sitede. Arkadaslar, Matbet son linki ac?kland?.

Matbet giriş adresi arıyorsanız doğru yerdesiniz. Maç izlemek için: Matbet Yeni Adres Canlı maçlar bu sitede. Gençler, Matbet bahis son linki belli oldu.

Gencler, Grandpashabet yeni adresi belli oldu. Adresi bulamayanlar buradan giris yapabilir https://grandpashabet.in.net/#

Matbet guncel linki laz?msa iste burada. Sorunsuz icin t?kla: Matbet Mobil Canl? maclar bu sitede. Gencler, Matbet yeni adresi belli oldu.

Chao c? nha, ai dang tim nha cai uy tin d? choi Casino d?ng b? qua trang nay nhe. Dang co khuy?n mai: Link vao BJ88. Chuc anh em may m?n.

Chao c? nha, ai dang tim nha cai uy tin d? cay cu?c Casino thi vao ngay ch? nay. N?p rut 1-1: Link khong b? ch?n. Hup l?c d?y nha.

Xin chao 500 anh em, ngu?i anh em nao c?n trang choi xanh chin d? gi?i tri N? Hu thi vao ngay con hang nay. Dang co khuy?n mai: https://pacebhadrak.org.in/#. Chuc anh em may m?n.

Hi các bác, nếu anh em đang kiếm cổng game không bị chặn để giải trí Nổ Hũ thì tham khảo con hàng này. Uy tín luôn: Nhà cái Dola789. Chúc các bác rực rỡ.

Hello m?i ngu?i, ai dang tim ch? n?p rut nhanh d? gi?i tri Da Ga thi xem th? ch? nay. Uy tin luon: https://homemaker.org.in/#. Hup l?c d?y nha.

Chào anh em, người anh em nào cần chỗ nạp rút nhanh để chơi Game bài đừng bỏ qua trang này nhé. Tốc độ bàn thờ: Tải app BJ88. Chúc anh em may mắn.

Xin chào 500 anh em, bác nào muốn tìm sân chơi đẳng cấp để giải trí Tài Xỉu thì vào ngay địa chỉ này. Không lo lừa đảo: Link tải Sunwin. Húp lộc đầy nhà.

Chao anh em, n?u anh em dang ki?m nha cai uy tin d? gi?i tri Game bai thi vao ngay con hang nay. Uy tin luon: Dang nh?p BJ88. Hup l?c d?y nha.

Xin chào 500 anh em, nếu anh em đang kiếm nhà cái uy tín để chơi Game bài thì xem thử chỗ này. Đang có khuyến mãi: Tải app BJ88. Húp lộc đầy nhà.

ivermectin pills canada: Iver Protocols Guide – cost of ivermectin cream

Elavil Generic Elavil buy Elavil

cost cheap propecia pill: cost of cheap propecia without rx – Follicle Insight

cost cheap propecia: Follicle Insight – Follicle Insight

ivermectin 2ml purchase oral ivermectin Iver Protocols Guide

stromectol 12mg: Iver Protocols Guide – Iver Protocols Guide

Follicle Insight: Follicle Insight – Follicle Insight

https://follicle.us.com/# Follicle Insight

https://fertilitypctguide.us.com/# clomid otc

Follicle Insight: generic propecia prices – Follicle Insight

where to get generic clomid online fertility pct guide fertility pct guide

propecia without prescription: order propecia without insurance – buying generic propecia online

https://iver.us.com/# stromectol medicine

AmiTrip Relief Store: Generic Elavil – Elavil

Generic Elavil: buy Elavil – Amitriptyline

https://follicle.us.com/# cost of propecia tablets

https://amitrip.us.com/# Amitriptyline

Iver Protocols Guide: ivermectin canada – Iver Protocols Guide

stromectol for humans: Iver Protocols Guide – Iver Protocols Guide

https://fertilitypctguide.us.com/# fertility pct guide

generic propecia online cost cheap propecia without insurance buying propecia without rx

https://fertilitypctguide.us.com/# fertility pct guide

fertility pct guide: how can i get cheap clomid without prescription – can you buy generic clomid without a prescription

https://amitrip.us.com/# Generic Elavil

Iver Protocols Guide: ivermectin cream cost – ivermectin lotion

buy cheap propecia tablets: buy cheap propecia without rx – buy cheap propecia pill

https://fertilitypctguide.us.com/# clomid without a prescription

Elavil: Elavil – Amitriptyline

https://amitrip.us.com/# buy Elavil

fertility pct guide can i purchase cheap clomid fertility pct guide

ivermectin buy nz: stromectol online canada – Iver Protocols Guide

https://follicle.us.com/# Follicle Insight

fertility pct guide: cost generic clomid pills – where buy clomid

https://amitrip.us.com/# Elavil

https://follicle.us.com/# Follicle Insight

buy generic propecia prices: Follicle Insight – Follicle Insight

buy propecia pills cost of propecia online generic propecia without a prescription

https://iver.us.com/# Iver Protocols Guide

AmiTrip Relief Store: AmiTrip – Amitriptyline

where can i get cheap clomid: fertility pct guide – can i purchase clomid without insurance

https://follicle.us.com/# Follicle Insight

https://amitrip.us.com/# Elavil

AmiTrip: Elavil – AmiTrip

fertility pct guide: can i order clomid for sale – fertility pct guide

https://amitrip.us.com/# buy Elavil

https://follicle.us.com/# get generic propecia without insurance

fertility pct guide fertility pct guide fertility pct guide

order generic clomid without insurance: can i buy cheap clomid for sale – how can i get clomid online

Hey everyone, I wanted to share a trusted health store to order medicines cheaply. Take a look at this site: toradol. Selling generic tablets and huge discounts. Hope this helps.

Hi, I recently found a useful article about prescription drugs, check out this health wiki. It covers usage and risks very well. Source: https://magmaxhealth.com/Methotrexate. Very informative.

Hey everyone, if you are looking for a trusted source for meds to purchase prescription drugs cheaply. I recommend this site: protonix. They offer a wide range of meds and huge discounts. Cheers.

Hi, for those searching for side effects info regarding various medications, check out this drug database. It explains usage and risks very well. Source: https://magmaxhealth.com/Celebrex. Hope it helps.

For a trusted source, check out this top-rated pharmacy here to order now. Get your meds today and save big.

To start saving, visit this reliable site here to order now. Get your meds today safely.

To understand the proper usage instructions, please review the official information page at: https://magmaxhealth.com/lamictal.html for correct administration.

Hi, I wanted to share a reliable drugstore to buy health products hassle-free. Take a look at this pharmacy: buspar. Selling high quality drugs at the best prices. Hope this helps.

Hello, if anyone needs side effects info on health treatments, I found this drug database. It explains drug interactions in detail. Read more here: https://magmaxhealth.com/Olanzapine. Very informative.

Hello, if anyone needs dosage instructions on various medications, check out this drug database. It covers how to take meds very well. Link: https://magmaxhealth.com. Hope it helps.

Hi, anyone searching for a great source for meds to buy prescription drugs online. I found MagMaxHealth: meclizine. They offer a wide range of meds and huge discounts. Hope this helps.

Greetings, I recently found dosage instructions regarding health treatments, take a look at this useful resource. You can read about how to take meds clearly. Source: https://magmaxhealth.com/Prilosec. Thanks.

For a complete overview of proper usage instructions, please review this resource: https://magmaxhealth.com/lipitor.html which covers safe treatment.

Hi all, if you are looking for side effects info about health treatments, check out this drug database. It explains drug interactions clearly. Link: https://magmaxhealth.com/Lipitor. Hope it helps.

Hi guys, I wanted to share a trusted online pharmacy to purchase pills online. I found this site: prilosec. Stocking a wide range of meds with fast shipping. Cheers.

For a complete overview of safety protocols, you can consult the detailed guide on: https://magmaxhealth.com/lipitor.html which covers correct administration.

Hello, if you are looking for a useful article about various medications, check out this useful resource. It explains safety protocols very well. See details: https://magmaxhealth.com/Methotrexate. Hope this is useful.

To understand the medical specifications, it is recommended to check the official information page at: https://magmaxhealth.com/buspar.html to ensure safe treatment.

Hi all, if anyone needs detailed information about health treatments, take a look at this useful resource. It covers safety protocols in detail. Source: https://magmaxhealth.com/Celebrex. Hope this is useful.

muscle relaxer tizanidine: Spasm Relief Protocols – tizanidine generic

methocarbamol dosing: zanaflex medication – over the counter muscle relaxers that work

ondansetron: Nausea Care US – ondansetron

generic for zofran generic for zofran ondansetron

https://gastrohealthmonitor.com/# omeprazole brand name

prilosec generic: Gastro Health Monitor – Gastro Health Monitor

tizanidine generic: Spasm Relief Protocols – tizanidine hydrochloride

muscle relaxant drugs: muscle relaxer tizanidine – tizanidine medication

methocarbamol medication: Spasm Relief Protocols – robaxin medication

Nausea Care US: Nausea Care US – zofran generic

https://nauseacareus.shop/# Nausea Care US

Nausea Care US: Nausea Care US – Nausea Care US

Gastro Health Monitor: prilosec dosage – Gastro Health Monitor

https://gastrohealthmonitor.com/# Gastro Health Monitor

antispasmodic medication: tizanidine hcl – tizanidine hcl

https://gastrohealthmonitor.shop/# Gastro Health Monitor

п»їomeprazole prilosec: Gastro Health Monitor – buy prilosec

omeprazole generic: Gastro Health Monitor – Gastro Health Monitor

Gastro Health Monitor Gastro Health Monitor Gastro Health Monitor

robaxin: antispasmodic medication – zanaflex medication

methocarbamol robaxin: robaxin generic – robaxin

https://nauseacareus.shop/# Nausea Care US

Gastro Health Monitor: Gastro Health Monitor – prilosec medication

methocarbamol robaxin: buy methocarbamol – buy tizanidine without prescription

prilosec otc: omeprazole medication – Gastro Health Monitor

tizanidine generic: over the counter muscle relaxers that work – methocarbamol medication

http://spasmreliefprotocols.com/# methocarbamol dosing

ondansetron zofran: generic zofran – zofran generic

Gastro Health Monitor: Gastro Health Monitor – prilosec medication

methocarbamol robaxin: antispasmodic medication – tizanidine muscle relaxer

methocarbamol robaxin: buy methocarbamol without prescription – tizanidine medication

https://gastrohealthmonitor.com/# omeprazole generic

ondestranon zofran: generic zofran – ondansetron medication

omeprazole prilosec: Gastro Health Monitor – Gastro Health Monitor

zanaflex: Spasm Relief Protocols – robaxin

п»їomeprazole prilosec: Gastro Health Monitor – prilosec side effects

generic prilosec: prilosec omeprazole – omeprazole medication

http://nauseacareus.com/# ondansetron zofran

Gastro Health Monitor: prilosec medication – omeprazole brand name

Nausea Care US: Nausea Care US – zofran otc

over the counter muscle relaxers that work: tizanidine hcl – methocarbamol robaxin

https://gastrohealthmonitor.com/# Gastro Health Monitor

http://spasmreliefprotocols.com/# methocarbamol dosing

Gastro Health Monitor: Gastro Health Monitor – buy prilosec

https://gastrohealthmonitor.shop/# omeprazole medication

zanaflex: Spasm Relief Protocols – buy methocarbamol without prescription

https://spasmreliefprotocols.shop/# muscle relaxer medication

omeprazole otc: omeprazole brand name – Gastro Health Monitor

https://nauseacareus.com/# zofran dosage

https://spasmreliefprotocols.shop/# zanaflex

tizanidine muscle relaxer: Spasm Relief Protocols – muscle relaxers over the counter

https://nauseacareus.shop/# zofran side effects

https://indogenericexport.com/# india online pharmacy

buy methocarbamol without prescription: muscle relaxer tizanidine – otc muscle relaxer

http://bajameddirect.com/# mexican pharmacy near me

order antibiotics from mexico: BajaMed Direct – BajaMed Direct

https://bajameddirect.shop/# mexican farmacia

https://usmedsoutlet.shop/# US Meds Outlet

meds from mexico: BajaMed Direct – BajaMed Direct

http://usmedsoutlet.com/# us pharmacy no prescription

mexican pharmacy that ships to the us: BajaMed Direct – purple pharmacy mexico

http://usmedsoutlet.com/# canadadrugpharmacy com

US Meds Outlet: US Meds Outlet – US Meds Outlet

https://bajameddirect.com/# BajaMed Direct

http://usmedsoutlet.com/# viagra canadian pharmacy vipps approved

US Meds Outlet: US Meds Outlet – tadalafil canadian pharmacy

https://bajameddirect.shop/# online mexico pharmacy

mexican meds: buying prescription drugs in mexico – mexican farmacia

https://usmedsoutlet.shop/# US Meds Outlet

script pharmacy: US Meds Outlet – US Meds Outlet

https://usmedsoutlet.com/# US Meds Outlet

online pharmacy: BajaMed Direct – best mexican pharmacy online

mail order pharmacy india: Indo-Generic Export – top 10 online pharmacy in india

http://usmedsoutlet.com/# US Meds Outlet

BajaMed Direct: farmacias mexicanas – mexican drug stores

http://usmedsoutlet.com/# US Meds Outlet

mexican medicine: BajaMed Direct – order from mexico

US Meds Outlet: US Meds Outlet – US Meds Outlet

http://indogenericexport.com/# tizanidine medication

Online medicine order: buy prescription drugs from india – pharmacy website india

mexican drug stores: mexican pharmacy online – farmacia mexicana online

reliable rx pharmacy: pharmacy rx – non prescription medicine pharmacy

pharmacies in mexico: BajaMed Direct – best mexican online pharmacy

US Meds Outlet: US Meds Outlet – US Meds Outlet

US Meds Outlet: online pharmacy india – US Meds Outlet

https://usmedsoutlet.com/# canada drugs coupon code

US Meds Outlet: US Meds Outlet – US Meds Outlet

india online pharmacy: Indo-Generic Export – mail order pharmacy india

http://usmedsoutlet.com/# online pharmacy worldwide shipping

buying drugs from canada: canadian pharmacies comparison – online pharmacy group

https://bajameddirect.shop/# BajaMed Direct

prescriptions from mexico: BajaMed Direct – los algodones pharmacy online

top 10 online pharmacy in india: Indo-Generic Export – cheapest online pharmacy india

canadian pharmacy online reviews: US Meds Outlet – safe canadian pharmacy

BajaMed Direct: BajaMed Direct – purple pharmacy online

http://usmedsoutlet.com/# US Meds Outlet

farmacias mexicanas: prescriptions from mexico – BajaMed Direct

https://indogenericexport.com/# п»їlegitimate online pharmacies india

BajaMed Direct: mexico pharmacy online – BajaMed Direct

global pharmacy: US Meds Outlet – US Meds Outlet

https://bajameddirect.shop/# mexico meds

BajaMed Direct: BajaMed Direct – BajaMed Direct

online pharmacy india: US Meds Outlet – trust pharmacy

https://usmedsoutlet.shop/# US Meds Outlet

top 10 online pharmacy in india: Indo-Generic Export – п»їlegitimate online pharmacies india

Sertraline USA: zoloft without rx – zoloft generic

http://ivertherapeutics.com/# stromectol 3 mg price

Smart GenRx USA: Smart GenRx USA – Smart GenRx USA

https://ivertherapeutics.com/# Iver Therapeutics

neurontin 300 mg mexico: neurontin 300 mg – gabapentin online

http://neuroreliefusa.com/# neurontin price in india

http://smartgenrxusa.com/# pharmacy delivery

generic zoloft: generic for zoloft – zoloft cheap

https://neuroreliefusa.shop/# Neuro Relief USA

Iver Therapeutics: Iver Therapeutics – Iver Therapeutics

https://sertralineusa.com/# zoloft generic

Sertraline USA: zoloft pill – zoloft generic

https://neuroreliefusa.com/# Neuro Relief USA

Neuro Relief USA: Neuro Relief USA – neurontin brand name 800 mg

https://ivertherapeutics.shop/# Iver Therapeutics

Iver Therapeutics: ivermectin 6mg – Iver Therapeutics

Neuro Relief USA Neuro Relief USA Neuro Relief USA

https://sertralineusa.com/# zoloft buy

us pharmacy: online pharmacy reviews – Smart GenRx USA

http://neuroreliefusa.com/# Neuro Relief USA

neurontin price south africa: Neuro Relief USA – Neuro Relief USA

Neuro Relief USA neurontin 214 neurontin 300 mg price

https://neuroreliefusa.shop/# neurontin 2400 mg

generic neurontin cost: neurontin medication – Neuro Relief USA

https://smartgenrxusa.shop/# Smart GenRx USA

Neuro Relief USA: neurontin 500 mg – Neuro Relief USA

http://sertralineusa.com/# zoloft without dr prescription

Smart GenRx USA: usa pharmacy online – Smart GenRx USA

https://neuroreliefusa.shop/# Neuro Relief USA

Iver Therapeutics: Iver Therapeutics – stromectol buy uk

http://ivertherapeutics.com/# Iver Therapeutics

order zoloft: sertraline zoloft – zoloft cheap

Neuro Relief USA brand name neurontin price Neuro Relief USA

https://ivertherapeutics.shop/# Iver Therapeutics

Iver Therapeutics: ivermectin 4000 mcg – Iver Therapeutics

https://neuroreliefusa.com/# neurontin 100mg discount

neurontin 100mg discount: buy neurontin canadian pharmacy – Neuro Relief USA

https://sertralineusa.shop/# generic for zoloft

discount pharmacy mexico pharmacy store australia online pharmacy free shipping

stromectol otc: Iver Therapeutics – ivermectin uk

my canadian pharmacy rx: southern pharmacy – Smart GenRx USA

https://ivertherapeutics.com/# Iver Therapeutics

order zoloft: zoloft without dr prescription – Sertraline USA

https://ivertherapeutics.shop/# Iver Therapeutics

Smart GenRx USA Smart GenRx USA Smart GenRx USA

sure save pharmacy: canadian pharmacy ed medications – all med pharmacy

https://smartgenrxusa.shop/# Smart GenRx USA

generic zoloft: zoloft generic – zoloft generic

https://neuroreliefusa.com/# neurontin prices generic

neurontin cost australia: buy neurontin uk – Neuro Relief USA

zoloft without dr prescription generic zoloft zoloft medication

https://smartgenrxusa.com/# Smart GenRx USA

Smart GenRx USA: Smart GenRx USA – Smart GenRx USA

https://ivertherapeutics.com/# Iver Therapeutics

Iver Therapeutics: cost of stromectol medication – ivermectin 500ml

order zoloft zoloft no prescription generic for zoloft

Iver Therapeutics: Iver Therapeutics – oral ivermectin cost

Smart GenRx USA: prices pharmacy – canadian pharmacy online reviews

https://neuroreliefusa.shop/# Neuro Relief USA

canada where to buy neurontin: buy neurontin – order neurontin

sertraline generic zoloft no prescription generic for zoloft

http://smartgenrxusa.com/# online pharmacy no rx

Iver Therapeutics: Iver Therapeutics – buy ivermectin canada

https://sertralineusa.com/# buy zoloft

Neuro Relief USA: neurontin 50mg tablets – 32 neurontin

http://sertralineusa.com/# Sertraline USA

http://ivertherapeutics.com/# Iver Therapeutics

Iver Therapeutics: Iver Therapeutics – buy liquid ivermectin

Neuro Relief USA Neuro Relief USA neurontin 800 pill

https://ivertherapeutics.shop/# purchase ivermectin

zoloft without rx: zoloft pill – order zoloft

zoloft cheap: buy zoloft – zoloft cheap

https://smartgenrxusa.shop/# canadian pharmacy near me

https://ivertherapeutics.com/# ivermectin 80 mg

stromectol buy uk: stromectol uk buy – ivermectin 90 mg

https://sertralineusa.shop/# sertraline generic

Neuro Relief USA Neuro Relief USA Neuro Relief USA

zoloft cheap: order zoloft – zoloft cheap

https://sertralineusa.com/# generic zoloft

buy ivermectin nz: ivermectin lice oral – Iver Therapeutics

https://smartgenrxusa.shop/# Smart GenRx USA

https://sertralineusa.com/# zoloft without dr prescription

reliable canadian pharmacy reviews: medstore online pharmacy – Smart GenRx USA

http://neuroreliefusa.com/# neurontin 3

Neuro Relief USA Neuro Relief USA neurontin 300 mg mexico

canadian pharmacy no prescription needed: wholesale pharmacy – peoples pharmacy

neurontin 300 mg cap: neurontin 100 mg cost – Neuro Relief USA

http://neuroreliefusa.com/# gabapentin medication

Neuro Relief USA: Neuro Relief USA – Neuro Relief USA

http://ivertherapeutics.com/# Iver Therapeutics

http://sertralineusa.com/# zoloft pill

Smart GenRx USA: best no prescription pharmacy – Smart GenRx USA

zoloft buy: zoloft generic – sertraline generic

http://sertralineusa.com/# zoloft tablet

Smart GenRx USA pharmacy today modafinil online pharmacy

ivermectin where to buy for humans: ivermectin lotion – Iver Therapeutics

Iver Therapeutics: ivermectin generic – Iver Therapeutics

https://ivertherapeutics.shop/# stromectol xr

http://ivertherapeutics.com/# stromectol generic name

zoloft generic: sertraline – zoloft generic

https://smartgenrxusa.com/# Smart GenRx USA

Iver Therapeutics: Iver Therapeutics – stromectol cvs

http://smartgenrxusa.com/# script pharmacy

Sertraline USA: zoloft without rx – zoloft buy

Neuro Relief USA neurontin cost in canada Neuro Relief USA

http://sertralineusa.com/# zoloft pill

Iver Therapeutics: Iver Therapeutics – ivermectin

neurontin 100mg cap: Neuro Relief USA – purchase neurontin

https://sertralineusa.com/# zoloft medication

ivermectin oral: Iver Therapeutics – ivermectin 3mg

zoloft buy: generic zoloft – buy zoloft

http://ivertherapeutics.com/# Iver Therapeutics

Neuro Relief USA Neuro Relief USA generic neurontin 600 mg

Neuro Relief USA: Neuro Relief USA – neurontin prescription medication

http://ivertherapeutics.com/# Iver Therapeutics

generic neurontin: neurontin 100 mg – Neuro Relief USA

ivermectin over the counter canada: ivermectin lice – stromectol ivermectin tablets

https://neuroreliefusa.com/# purchase neurontin canada

cost of ivermectin pill: stromectol ireland – Iver Therapeutics

Iver Therapeutics: ivermectin brand name – ivermectin buy nz

http://neuroreliefusa.com/# Neuro Relief USA

zoloft no prescription: Sertraline USA – zoloft pill

https://smartgenrxusa.com/# Smart GenRx USA

generic for zoloft: buy zoloft – sertraline

http://smartgenrxusa.com/# canada drug pharmacy

sertraline zoloft: Sertraline USA – zoloft medication

http://neuroreliefusa.com/# where to buy neurontin

pharmacy online australia free shipping: canadapharmacyonline – canada drug pharmacy

zoloft buy generic for zoloft zoloft generic

Iver Therapeutics: ivermectin oral – Iver Therapeutics

https://ivertherapeutics.shop/# cost of ivermectin cream

https://sertralineusa.shop/# zoloft medication

Iver Therapeutics: Iver Therapeutics – where to buy stromectol

Smart GenRx USA: Smart GenRx USA – no rx pharmacy

http://smartgenrxusa.com/# Smart GenRx USA

Iver Therapeutics: ivermectin 90 mg – ivermectin tablets uk

https://ivertherapeutics.com/# Iver Therapeutics

buy zoloft zoloft without dr prescription Sertraline USA

sertraline: zoloft without dr prescription – zoloft without rx

zoloft without dr prescription: zoloft pill – zoloft pill

https://sertralineusa.shop/# generic for zoloft

https://ivertherapeutics.com/# ivermectin over the counter

300 mg neurontin: neurontin 800 mg pill – neurontin 100mg cap

canadian pharmacy phone number: canadian online pharmacy viagra – Smart GenRx USA

https://sertralineusa.shop/# zoloft generic

canada where to buy neurontin: Neuro Relief USA – discount neurontin

ivermectin buy ivermectin uk coronavirus Iver Therapeutics

https://neuroreliefusa.com/# how to get neurontin cheap

Iver Therapeutics: Iver Therapeutics – ivermectin iv

https://smartgenrxusa.shop/# Smart GenRx USA

canadian pharmacy viagra reviews: Smart GenRx USA – Smart GenRx USA

http://sertralineusa.com/# zoloft medication

online pharmacy 365 pills: Smart GenRx USA – reliable canadian pharmacy

http://ivertherapeutics.com/# ivermectin pill cost

zoloft without rx: generic for zoloft – buy zoloft

https://smartgenrxusa.shop/# Smart GenRx USA

https://smartgenrxusa.com/# online pharmacy quick delivery

Smart GenRx USA: canadian pharmacy oxycodone – Smart GenRx USA

cost of stromectol medication: ivermectin 6mg dosage – ivermectin for sale

https://neuroreliefusa.shop/# Neuro Relief USA

buy generic neurontin: neurontin 300 mg buy – neurontin sale

canadianpharmacyworld: Smart GenRx USA – Smart GenRx USA

https://sertralineusa.shop/# sertraline

http://neuroreliefusa.com/# neurontin 300 mg coupon

Smart GenRx USA: online pharmacy delivery delhi – canadian pharmacy levitra value pack

neurontin 2018 Neuro Relief USA Neuro Relief USA

https://smartgenrxusa.shop/# pharmacy coupons

zoloft cheap: zoloft tablet – generic for zoloft

ivermectin 3mg: stromectol 3 mg dosage – Iver Therapeutics

https://sertralineusa.shop/# sertraline

generic zoloft: generic zoloft – zoloft cheap

trusted canadian pharmacy: online pharmacy dubai – Smart GenRx USA

http://ivertherapeutics.com/# Iver Therapeutics

https://sertralineusa.shop/# zoloft no prescription

buy ivermectin uk Iver Therapeutics stromectol nz

canadian pharmacy ratings: Smart GenRx USA – Smart GenRx USA

zoloft without rx: zoloft generic – zoloft generic

https://neuroreliefusa.com/# Neuro Relief USA

zoloft cheap: zoloft generic – zoloft without dr prescription

http://ivertherapeutics.com/# stromectol online

http://neuroreliefusa.com/# Neuro Relief USA

Neuro Relief USA: neurontin 330 mg – Neuro Relief USA

https://neuroreliefusa.com/# Neuro Relief USA

neurontin price in india: neurontin medication – neurontin 800 mg pill

Smart GenRx USA reputable canadian pharmacy pharmacy website india

Smart GenRx USA: canadian pharmacy online cialis – Smart GenRx USA

http://sertralineusa.com/# sertraline

india pharmacy mail order: Smart GenRx USA – Smart GenRx USA

http://sertralineusa.com/# sertraline zoloft

https://ivertherapeutics.com/# Iver Therapeutics

Neuro Relief USA: neurontin 600 – neurontin 900 mg

Iver Therapeutics: ivermectin tablets – ivermectin 2%

https://smartgenrxusa.com/# best online pharmacy india

Neuro Relief USA: Neuro Relief USA – Neuro Relief USA

Iver Therapeutics ivermectin cream 1% Iver Therapeutics

mexico pharmacy order online: legitimate online pharmacy usa – the pharmacy

http://neuroreliefusa.com/# neurontin 300 mg tablets

https://sertralineusa.com/# Sertraline USA

canadian pharmacy tampa: Smart GenRx USA – Smart GenRx USA

https://neuroreliefusa.com/# Neuro Relief USA

Neuro Relief USA: Neuro Relief USA – neurontin prices

Iver Therapeutics: п»їorder stromectol online – Iver Therapeutics

https://ivertherapeutics.shop/# Iver Therapeutics

Iver Therapeutics Iver Therapeutics Iver Therapeutics

http://smartgenrxusa.com/# canadian pharmacy sildenafil

neurontin price india: Neuro Relief USA – Neuro Relief USA

canada drugs online review: Smart GenRx USA – indianpharmacy com

https://sertralineusa.shop/# zoloft no prescription

buy zoloft: zoloft medication – sertraline

http://smartgenrxusa.com/# best canadian online pharmacy reviews

neurontin 300 mg price: neurontin 100 mg capsule – Neuro Relief USA

http://neuroreliefusa.com/# Neuro Relief USA

Smart GenRx USA: Smart GenRx USA – Smart GenRx USA

https://ivertherapeutics.com/# Iver Therapeutics

Smart GenRx USA reliable canadian pharmacy reviews legitimate canadian pharmacy online

ivermectin 2%: Iver Therapeutics – Iver Therapeutics

https://ivertherapeutics.com/# Iver Therapeutics

п»їorder stromectol online: stromectol buy uk – Iver Therapeutics

http://ivertherapeutics.com/# ivermectin brand name

stromectol liquid: stromectol 3 mg tablet – stromectol 3 mg tablets price

neurontin cap: neurontin 800 mg cost – buying neurontin without a prescription

https://ivertherapeutics.shop/# stromectol ivermectin 3 mg

generic zoloft: zoloft buy – sertraline

zoloft buy generic zoloft generic for zoloft

Neuro Relief USA: Neuro Relief USA – Neuro Relief USA

http://vetfreemeds.com/# best pet rx

My Mexican Pharmacy: My Mexican Pharmacy – mail order pharmacy mexico

https://mymexicanpharmacy.com/# My Mexican Pharmacy

https://vetfreemeds.com/# pet pharmacy online

canadian pharmacy ltd: CertiCanPharmacy – CertiCanPharmacy

pet rx: online pet pharmacy – vet pharmacy online

http://mymexicanpharmacy.com/# My Mexican Pharmacy

https://certicanpharmacy.shop/# buy drugs from canada

canadian discount pharmacy: northwest pharmacy canada – best rated canadian pharmacy

https://certicanpharmacy.shop/# canadian pharmacy world

cheap canadian pharmacy: CertiCanPharmacy – medication canadian pharmacy

https://vetfreemeds.shop/# discount pet meds

mexico online pharmacy: farmacia mexicana en linea – pharma mexicana

https://mymexicanpharmacy.shop/# mexico prescriptions

mexican pharmacy online My Mexican Pharmacy online pharmacies

https://vetfreemeds.com/# pet meds official website

dog prescriptions online: best pet rx – pet pharmacy

pharmacia mexico: mexico medicine – My Mexican Pharmacy

https://vetfreemeds.shop/# pet rx

https://mymexicanpharmacy.shop/# My Mexican Pharmacy

https://mymexicanpharmacy.shop/# My Mexican Pharmacy

My Mexican Pharmacy My Mexican Pharmacy mexican pharmacy near me

https://mymexicanpharmacy.com/# pharmacy in mexico that ships to us

dog medicine: pet pharmacy – pet pharmacy online

My Mexican Pharmacy: My Mexican Pharmacy – online pharmacies in mexico

http://vetfreemeds.com/# pet prescriptions online

My Mexican Pharmacy: My Mexican Pharmacy – mexico pharmacy price list

https://vetfreemeds.shop/# pet drugs online

http://certicanpharmacy.com/# CertiCanPharmacy

dog medicine: VetFree Meds – pet pharmacy online

mexipharmacy reviews: My Mexican Pharmacy – My Mexican Pharmacy

http://mymexicanpharmacy.com/# My Mexican Pharmacy

best mexican pharmacy online My Mexican Pharmacy pharmacies in mexico

http://vetfreemeds.com/# best pet rx

pharmacy mexico: My Mexican Pharmacy – My Mexican Pharmacy

https://mymexicanpharmacy.shop/# mexican rx

cross border pharmacy canada: CertiCanPharmacy – CertiCanPharmacy

http://mymexicanpharmacy.com/# mexican online pharmacy wegovy

dog prescriptions online: VetFree Meds – pet meds official website

https://certicanpharmacy.com/# canadian world pharmacy

vet pharmacy VetFree Meds pet rx

best pet rx: VetFree Meds – vet pharmacy online

https://vetfreemeds.com/# vet pharmacy online

https://certicanpharmacy.com/# canadianpharmacyworld com

pet med: VetFree Meds – canada pet meds

pet rx: VetFree Meds – pet pharmacy online

https://vetfreemeds.com/# discount pet meds

http://mymexicanpharmacy.com/# farmacias online usa

order medication from mexico: My Mexican Pharmacy – mexican pharmacy menu

My Mexican Pharmacy: pharmacies in mexico that ship to the us – farmacia mexicana online

п»їdog medication online pet pharmacy pet pharmacy online

https://mymexicanpharmacy.com/# mexico farmacia

https://mymexicanpharmacy.shop/# mexican pharmacies

CertiCanPharmacy: CertiCanPharmacy – CertiCanPharmacy

https://certicanpharmacy.com/# canada drugs

https://certicanpharmacy.com/# CertiCanPharmacy

mexican pharmacy online: phentermine in mexico pharmacy – My Mexican Pharmacy

pet prescriptions online: pet prescriptions online – dog prescriptions online

https://mymexicanpharmacy.com/# mexico pharmacy price list

https://mymexicanpharmacy.com/# My Mexican Pharmacy

pet meds online VetFree Meds pet drugs online

CertiCanPharmacy: best canadian pharmacy to buy from – CertiCanPharmacy

cheap canadian pharmacy online: CertiCanPharmacy – canadian pharmacy meds

https://vetfreemeds.shop/# online pet pharmacy

https://mymexicanpharmacy.shop/# order medication from mexico

CertiCanPharmacy: canada pharmacy 24h – canadian drugs online

https://vetfreemeds.shop/# online pet pharmacy

http://certicanpharmacy.com/# best canadian online pharmacy

pharmacy mexico: My Mexican Pharmacy – pharmacy in mexico city

canadian pharmacies that deliver to the us: canadian pharmacy – CertiCanPharmacy

https://mymexicanpharmacy.com/# phentermine in mexico pharmacy

http://certicanpharmacy.com/# CertiCanPharmacy

meds from mexico: My Mexican Pharmacy – My Mexican Pharmacy

https://certicanpharmacy.shop/# best canadian pharmacy to order from

http://mymexicanpharmacy.com/# pharmacy online

My Mexican Pharmacy: farmacias online usa – My Mexican Pharmacy

pet meds official website: pet meds official website – canada pet meds

https://mymexicanpharmacy.shop/# mexican online pharmacy

https://certicanpharmacy.com/# canadian pharmacy online ship to usa

canada pet meds: pet pharmacy online – pet meds official website

online pharmacies in mexico: pharmacy in mexico that ships to us – My Mexican Pharmacy

http://certicanpharmacy.com/# CertiCanPharmacy

http://mymexicanpharmacy.com/# My Mexican Pharmacy

п»їdog medication online: pet prescriptions online – online pet pharmacy

http://mymexicanpharmacy.com/# My Mexican Pharmacy

https://mymexicanpharmacy.shop/# My Mexican Pharmacy

pharmacies in mexico that ship to the us: pharmacy mexico – My Mexican Pharmacy

vet pharmacy online vet pharmacy pet pharmacy

My Mexican Pharmacy: purple pharmacy – My Mexican Pharmacy

https://vetfreemeds.com/# pet prescriptions online

http://mymexicanpharmacy.com/# mexican pharmacy near me

pet med: п»їdog medication online – dog prescriptions online

My Mexican Pharmacy: mexican rx – purple pharmacy mexico

http://vetfreemeds.com/# pet prescriptions online

https://vetfreemeds.com/# pet drugs online

best pet rx: VetFree Meds – pet pharmacy

CertiCanPharmacy CertiCanPharmacy CertiCanPharmacy

https://certicanpharmacy.shop/# CertiCanPharmacy

https://mymexicanpharmacy.shop/# My Mexican Pharmacy

vet pharmacy: VetFree Meds – dog prescriptions online

discount pet meds: vet pharmacy – pet pharmacy online

https://vetfreemeds.shop/# pet meds online

https://certicanpharmacy.shop/# canada cloud pharmacy

canada pet meds: pet rx – pet prescriptions online

mexico meds: mexico pharmacy online – My Mexican Pharmacy

canadian pharmacy uk delivery CertiCanPharmacy CertiCanPharmacy

https://vetfreemeds.shop/# pet meds official website

https://mymexicanpharmacy.com/# My Mexican Pharmacy

order antibiotics from mexico: mexico city pharmacy – mexican farmacia

http://vetfreemeds.com/# pet drugs online

canadian pharmacy world: CertiCanPharmacy – CertiCanPharmacy

https://mymexicanpharmacy.com/# mexico prescriptions

canadian online pharmacy: CertiCanPharmacy – CertiCanPharmacy

mexico rx: My Mexican Pharmacy – My Mexican Pharmacy

https://mymexicanpharmacy.shop/# order meds from mexico

http://vetfreemeds.com/# online pet pharmacy

My Mexican Pharmacy My Mexican Pharmacy mexico pharmacy

My Mexican Pharmacy: My Mexican Pharmacy – mexico pharmacy

https://vetfreemeds.shop/# pet meds for dogs

My Mexican Pharmacy: my mexican pharmacy – My Mexican Pharmacy

http://certicanpharmacy.com/# thecanadianpharmacy

canadian pharmacy discount code: US Pharma Index – US Pharma Index

http://uspharmaindex.com/# online pharmacy discount code

https://ivermectinaccessusa.com/# ivermectin 9 mg

my canadian pharmacy rx online pharmacy europe US Pharma Index

US Pharma Index: online otc pharmacy – US Pharma Index

canada drugs online: canadapharmacyonline legit – which pharmacy is cheaper

http://sildenafilpriceguide.com/# Sildenafil Citrate Tablets 100mg

https://uspharmaindex.com/# US Pharma Index

US Pharma Index: canadian pharmacy checker – US Pharma Index

https://uspharmaindex.com/# best rogue online pharmacy

https://sildenafilpriceguide.shop/# Cheap Viagra 100mg

where to buy ivermectin pills: Ivermectin Access USA – buy ivermectin nz

Ivermectin Access USA Ivermectin Access USA Ivermectin Access USA

reddit canadian pharmacy: best no prescription pharmacy – US Pharma Index

https://ivermectinaccessusa.com/# ivermectin 1mg

http://ivermectinaccessusa.com/# Ivermectin Access USA

legitimate online pharmacy uk: pharmacy online 365 discount code – vipps canadian pharmacy

US Pharma Index: canadian pharmacy cialis 20mg – legitimate canadian mail order pharmacy

http://uspharmaindex.com/# US Pharma Index

https://ivermectinaccessusa.shop/# stromectol for humans

canadian pharmacy sildenafil: US Pharma Index – US Pharma Index

US Pharma Index reliable canadian pharmacy canadian compounding pharmacy

https://uspharmaindex.com/# online pharmacy delivery dubai

https://uspharmaindex.com/# US Pharma Index

pharmacy prices: US Pharma Index – safe online pharmacies

US Pharma Index: US Pharma Index – US Pharma Index

US Pharma Index: US Pharma Index – pharmacy

http://ivermectinaccessusa.com/# ivermectin human

https://uspharmaindex.shop/# US Pharma Index

precription drugs from canada US Pharma Index online pharmacy meds

legit pharmacy websites: order pharmacy online egypt – pill pharmacy

http://sildenafilpriceguide.com/# buy viagra here

https://ivermectinaccessusa.com/# ivermectin pills canada

best canadian pharmacy online: usa pharmacy online – US Pharma Index

US Pharma Index: US Pharma Index – US Pharma Index

https://ivermectinaccessusa.com/# Ivermectin Access USA

https://sildenafilpriceguide.shop/# sildenafil 50 mg price

stromectol over the counter: Ivermectin Access USA – buy ivermectin pills

Sildenafil Citrate Tablets 100mg: over the counter sildenafil – buy viagra here

Ivermectin Access USA ivermectin 80 mg Ivermectin Access USA

http://ivermectinaccessusa.com/# purchase oral ivermectin

http://sildenafilpriceguide.com/# cheap viagra

US Pharma Index: US Pharma Index – US Pharma Index

http://sildenafilpriceguide.com/# buy Viagra online

http://ivermectinaccessusa.com/# ivermectin pills human

US Pharma Index: US Pharma Index – US Pharma Index

cost of ivermectin: stromectol online pharmacy – Ivermectin Access USA

https://ivermectinaccessusa.com/# ivermectin

https://sildenafilpriceguide.com/# Cheap Sildenafil 100mg

Ivermectin Access USA ivermectin price uk where to buy ivermectin pills

US Pharma Index: US Pharma Index – US Pharma Index

over the counter sildenafil: buy Viagra over the counter – buy Viagra over the counter

https://sildenafilpriceguide.shop/# Order Viagra 50 mg online

https://ivermectinaccessusa.com/# ivermectin 5

US Pharma Index: cheapest pharmacy to fill prescriptions with insurance – US Pharma Index

https://uspharmaindex.com/# online pharmacy birth control pills

https://ivermectinaccessusa.com/# Ivermectin Access USA

sildenafil online: Sildenafil Price Guide – sildenafil 50 mg price

buy Viagra over the counter: sildenafil 50 mg price – order viagra

US Pharma Index US Pharma Index no rx pharmacy

https://uspharmaindex.com/# affordable pharmacy

http://uspharmaindex.com/# US Pharma Index

http://uspharmaindex.com/# US Pharma Index

US Pharma Index: US Pharma Index – US Pharma Index

https://sildenafilpriceguide.com/# cheap viagra

http://sildenafilpriceguide.com/# generic sildenafil

US Pharma Index US Pharma Index canadian pharmacy victoza

http://sildenafilpriceguide.com/# best price for viagra 100mg

Buy Viagra online cheap: Sildenafil Price Guide – generic sildenafil

sildenafil over the counter: Sildenafil Price Guide – Buy generic 100mg Viagra online

https://uspharmaindex.shop/# online pharmacy weight loss

http://ivermectinaccessusa.com/# buy stromectol pills

Cheapest Sildenafil online: Sildenafil 100mg price – Order Viagra 50 mg online

https://sildenafilpriceguide.com/# Sildenafil Citrate Tablets 100mg

Viagra Tablet price: Viagra Tablet price – Viagra Tablet price

https://sildenafilpriceguide.com/# Viagra online price

US Pharma Index: US Pharma Index – US Pharma Index

ivermectin lotion stromectol order online cost of ivermectin

https://sildenafilpriceguide.shop/# Viagra Tablet price

Cheap generic Viagra online: Viagra without a doctor prescription Canada – Buy generic 100mg Viagra online

https://sildenafilpriceguide.shop/# Cheap Sildenafil 100mg

US Pharma Index: canada cloud pharmacy – cheap canadian pharmacy online

https://ivermectinaccessusa.shop/# stromectol covid

Ivermectin Access USA: Ivermectin Access USA – Ivermectin Access USA

https://uspharmaindex.com/# best no prescription pharmacy

https://uspharmaindex.shop/# safe canadian pharmacy

legitimate online pharmacy uk US Pharma Index US Pharma Index

Buy generic 100mg Viagra online: Sildenafil Price Guide – cheap viagra

Order Viagra 50 mg online: Sildenafil Price Guide – cheapest viagra

https://uspharmaindex.shop/# US Pharma Index

https://sildenafilpriceguide.com/# Viagra online price

Sildenafil Citrate Tablets 100mg: Sildenafil Price Guide – Viagra generic over the counter

http://uspharmaindex.com/# US Pharma Index

https://sildenafilpriceguide.com/# buy Viagra online

Ivermectin Access USA: Ivermectin Access USA – ivermectin oral

Viagra generic over the counter: Sildenafil Price Guide – Sildenafil 100mg price

http://uspharmaindex.com/# canadian pharmacies compare

viagra canada Cheap generic Viagra online sildenafil over the counter