Kelly Ifill, the founder of Guava, an online banking platform aimed at Black small-business owners, launched the platform to address the lack of access to capital and banking options for Black entrepreneurs. With a deep understanding of the challenges faced by entrepreneurs, Ifill sought to provide a solution that could help Black business owners get their ventures off the ground. Guava has gained more than 3,000 members in just seven months, attracting a diverse range of businesses.

Access to capital remains a significant barrier for Black-owned businesses, with less than 2% of venture funding going to Black-owned startups and less than 1% to companies led by Black women. Historical underbanking in Black communities has led to difficulties in accessing commercial banking accounts, which are essential for businesses to store their cash. Moreover, these businesses often lack the support and mentoring that typically come with venture capital backing and banking resources, leaving them with limited guidance.

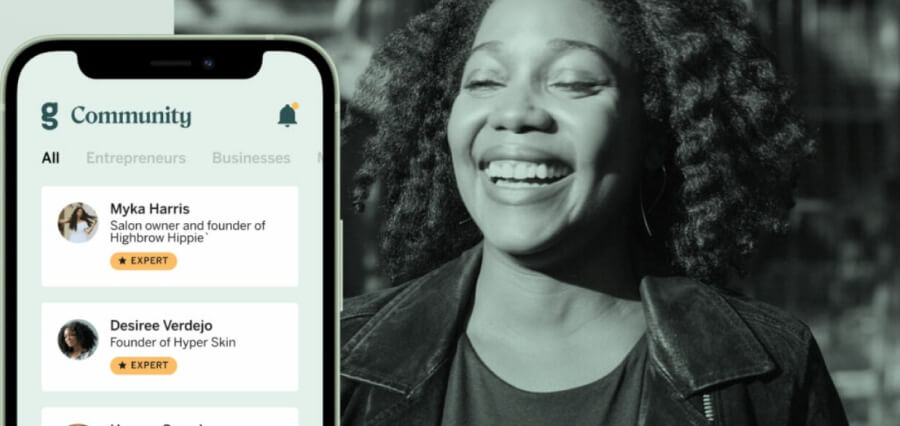

Guava, though not a traditional bank, offers banking services through partnerships with established banks, allowing small-business owners to open checking accounts for their businesses and access resources that can help them grow and succeed. Guava’s focus on creating a networking hub called Huddle provides members with a platform to share knowledge and learn from industry and financial experts.

While Guava acknowledges that it can’t single-handedly close the racial wealth gap, it aims to contribute to the economic empowerment of Black business owners. Greater investment in minority-owned businesses has been shown to yield higher returns for investors and could potentially add over $2 trillion to the broader economy. By providing a dedicated platform and resources for Black entrepreneurs, Guava hopes to drive positive change and help unlock the full potential of the small business economy.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Access to capital remains a significant barrier for Black-owned businesses, with less than 2% of venture funding going to Black-owned startups and less than 1% to companies led by Black women. Historical underbanking in Black communities has led to difficulties in accessing commercial banking accounts, which are essential for businesses to store their cash. Moreover, these businesses often lack the support and mentoring that typically come with venture capital backing and banking resources, leaving them with limited guidance.

You have a very good site. This is really a great job to do and publish it for the user and let them use it for their usage and knowledge. I really appreciate it personally, As I’ve also started to learn and this site helps me lot to understand the basics and other uses. Specially, I have learnt lots of useful thing from you. Those are really helpful and useful to understand it. I’m a part time blogger and frequently writing about some other topics. You might like to visit :

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.